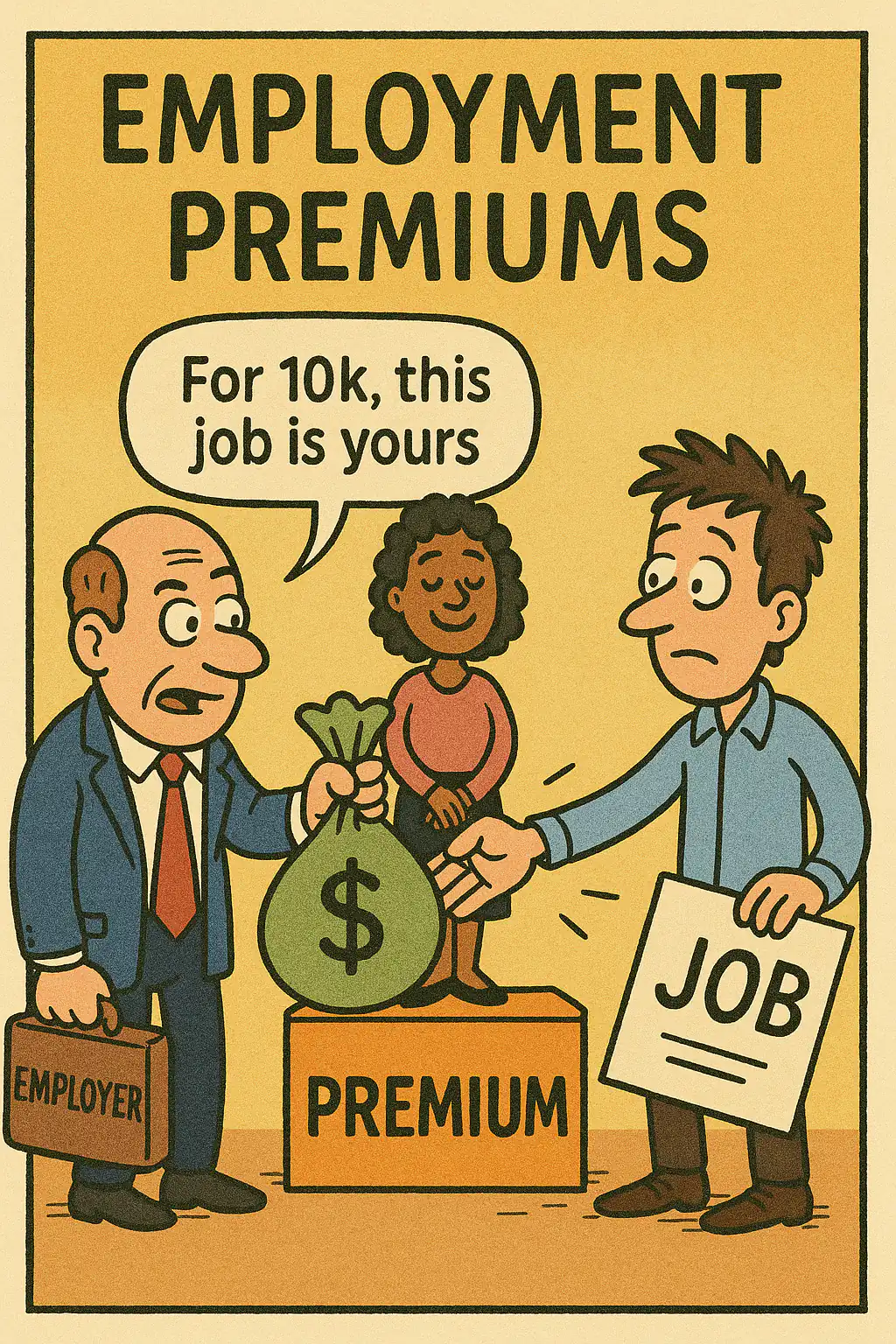

Employment Premiums

What It Is

An employment premium occurs when an employer or agent demands or receives money, gifts, or other benefits from a worker as a condition of getting or keeping a job.

This practice is unlawful in New Zealand and is considered a form of worker exploitation under the Wages Protection Act 1983, Employment Relations Act 2000 (ERA 2000), and Immigration Act 2009.

Examples of illegal employment premiums include:

- Paying your employer or recruiter to secure a job offer or visa.

- Being forced to pay “bond money,” “training fees,” or “visa costs” that the employer should cover.

- Deductions from wages for recruitment, accommodation, or travel that are not authorised in writing.

- Retaining part of your pay or requiring you to “refund” wages to the employer.

Your Rights and the Law

- Wages Protection Act 1983 s 12A — Employers and their agents cannot demand or receive money or any valuable consideration from employees in exchange for work or continued employment.

- Minimum Wage Act 1983 s 6 — Employees must be paid at least the statutory minimum wage for every hour worked, without deductions reducing pay below this level.

- ERA 2000 s 4 — Requires employers to act in good faith, including in recruitment and payment arrangements.

- Immigration Act 2009 ss 351–353 — Makes it a criminal offence to exploit migrants by demanding premiums or unlawful payments.

Process (How a Case Generally Proceeds)

- Identify the Payment or Deduction – Keep records of any payments made or deductions from pay.

- Request Explanation in Writing – Ask your employer or recruiter for legal justification and written consent forms.

- Raise a Personal Grievance – If the demand caused disadvantage, raise under ERA s 103(1)(b) within 90 days.

- Report to MBIE or Labour Inspectorate – Labour Inspectors can investigate and recover illegally paid premiums.

- Mediation – The Ministry of Business, Innovation & Employment (MBIE) provides free mediation to seek early resolution. The process is voluntary and both parties must agree to attend. Most cases reach resolution at Mediation.

- Employment Relations Authority Investigation – If unresolved, a Statement of Problem is filed; the Authority investigates and issues a written determination. ERA may order repayment, penalties, or refer serious matters to the Employment Court.

- Employment Court Appeal – Possible for errors of law or procedure.

- Criminal Proceedings – In cases of deliberate exploitation, the Labour Inspectorate or Immigration NZ may prosecute.

Potential Outcomes / Remedies

- Full repayment of all money or benefits unlawfully demanded.

- Compensation for humiliation, loss of dignity, and financial hardship (ERA s 123).

- Civil penalties for employers or recruiters (up to $50 000 for individuals, $100 000 for companies).

- Criminal convictions for exploitation under the Immigration Act 2009.

- Licence suspension or revocation for recruiters and labour-hire firms.

Take Action Today

If you have been asked to pay money, provide gifts, or refund wages to secure or keep your job, it may be an unlawful employment premium. Get in touch with us to arrange a no-obligation consultation about your situation. We’ll assess your case, explain your options, help gather evidence, request your employment file, and help you pursue the justice and compensation you deserve. Our advocates can help you recover lost wages, report exploitation safely, and hold employers accountable under the Wages Protection Act 1983, ERA 2000, and Immigration Act 2009.